A Guide to Canada's F.H.S.A

The dream of owning your first home has undergone significant changes due to factors like housing prices, inflation, and fluctuating interest rates. Overcoming these challenges requires innovative financial strategies. In this pursuit, the Canadian government has introduced the First Home Savings Account (FHSA) – a tax-free registered plan designed to assist potential first-time home buyers in achieving their homeownership goals.

What is the FHSA? The FHSA is a novel registered plan tailored to aid Canadians in entering the housing market. It acts as a savings account specifically for the purpose of purchasing a qualifying first home. The term "qualifying home" encompasses various housing units in Canada, ranging from single-family homes to apartment buildings.

Am I Eligible for the FHSA? Determining your eligibility for the FHSA involves several factors:

- Canadian Residency: You must be a Canadian resident.

- Age Criteria: Depending on the type of FHSA, you may need to be the age of majority in your province or territory of residence, which is generally 18 years.

- First-Time Homebuyer: To qualify, you should be a first-time homebuyer.

- Past Homeownership: In the calendar year before opening the account or within the previous four calendar years, you shouldn't have owned or lived in a qualifying home.

- Principal Residence: The home you intend to purchase or build should become your principal residence.

How Much Can I Contribute to an FHSA? The FHSA offers eligible Canadians the opportunity to contribute up to $8,000 annually. This contribution room can accumulate if not utilized fully, up to a lifetime maximum of $40,000. For instance, if you contribute $4,000 in one year, your contribution limit for the following year would be $12,000 ($8,000 + $4,000).

Advantages of an FHSA: Utilizing the FHSA offers several benefits:

- Tax Deduction: Contributions made to the FHSA can be claimed as tax deductions, resulting in potential tax savings.

- Tax-Free Growth: Investments within the FHSA grow tax-free, providing an opportunity to maximize your savings.

- Tax-Free Withdrawals: When you're ready to purchase a qualifying first home, you can withdraw both your contributions and investment earnings tax-free.

- Combined Strategies: You can use funds from both the FHSA and the RRSP Home Buyer's Plan for your first home purchase.

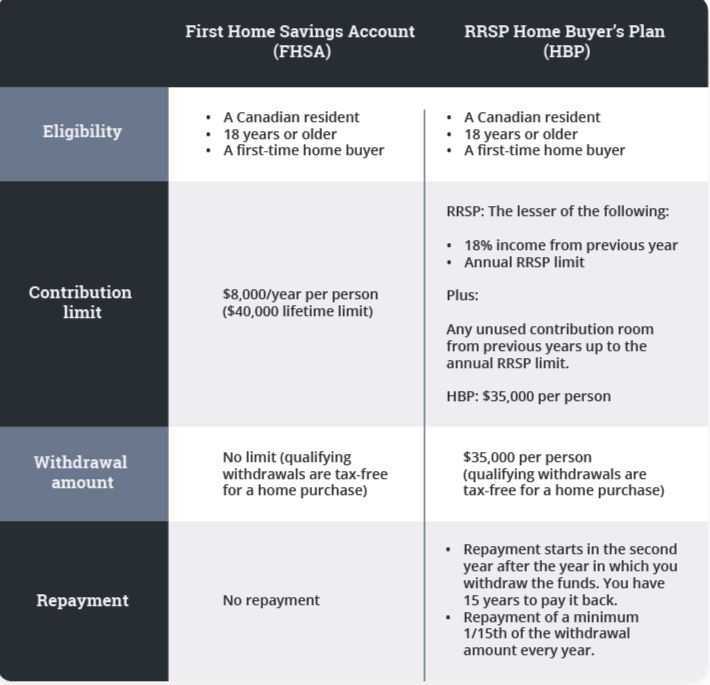

FHSA vs. RRSP: A Comparison

Image Source*Questtrade

Image Source*Questtrade

Navigating the challenges of purchasing your first home requires innovative financial solutions. The FHSA offers Canadians a strategic way to save for their qualifying first home while benefiting from tax deductions, tax-free growth, and tax-free withdrawals. Moreover, the option to combine the FHSA with the RRSP Home Buyer's Plan provides added flexibility. By harnessing these tools, aspiring homeowners can embark on their homeownership journey with a stronger financial foundation.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "